Opportunity Zones: The Who, What, Where, When, Why and How

Opportunity Zones have become one of the most popular topics to come out of the Tax Cuts and Jobs Act of 2017.

Yet, most people still find themselves scratching their heads when it comes to decoding the details surrounding the Opportunity Zones provision and the labyrinth of regulations and requirements that go along with it (not to mention keeping up with new ones).

That’s why we’ve outlined the basics here.

Opportunity Zones: The Who

The Opportunity Zone program is geared towards taxpayers with realized capital gains looking to invest in real estate projects or in operating businesses within the boundaries of an Opportunity Zone.

These opportunities are open to eligible taxpayers who are required to report the recognition of capital gains on their tax returns. This includes, but is not limited to:

- Individuals

- C Corporations

- Partnerships

- S Corporations

- Trusts

- Estates

Opportunity Zones: The What

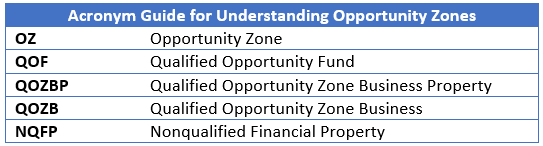

Opportunity Zones (OZs) are state-selected and federally designated census tracts that 2010 census data reflected to be low-income, under-developed areas in need of an economic revival.

Because the legislation passed in the Tax Cuts and Jobs Act of 2017 used data from 2010, some of these tracts were already on an up-trend when they were designated.

Taxpayers do not have to live or sell property within the OZs to benefit from the program, but, rather, must inject new capital into these areas in the hopes of spurring long-term positive economic activity.

Opportunity Zones: The Where

Opportunity Zones are found across the country, with each state having multiple zones scattered throughout—from rural areas to downtowns in need of economic development. The below map shows the number of OZs across the Southeast.

Opportunity Zones: The When

There is no more important factor for an Opportunity Zone investment than timing.

Taxpayers have 180 days from realizing a capital gain (with some exceptions) to invest cash (or other property) into a Qualified Opportunity Fund (QOF).

If the capital gain is realized through a pass-through entity, there are some options to extend the time period needed to invest in a QOF. Investors realizing capital gains from a pass-through entity have three dates from which they can start their 180-day investment period:

- 180 days from when the pass-through entity realizes the gain

- 180 days from the end of the pass-through entity’s taxable year

- 180 days from the original due date of the pass-through entity’s tax return

After investing in a QOF, taxpayers will need to be wary of their timing as it relates to the 90% Asset Test in order to maintain compliance with the rules and regulations that govern the Opportunity Zones program.

Opportunity Zones: The Why

Taxpayers who invest in an Opportunity Zone receive three tax benefits when it comes to their eligible investment connected to deferred capital gains:

- Immediate deferral of capital gains tax liabilities up to the earlier of when the taxpayer sells their investment or December 31, 2026;

- A permanent 10% exclusion of the original deferred capital gain if the investment is held for at least five years ending before December 31, 2026; and

- A permanent exclusion of gain recognized on the appreciation of an Opportunity Zone investment if the investment is held for at least 10 years (up to 2047).

Opportunity Zones: The How

Taxpayers will use their QOF capital to invest in Qualified Opportunity Zone Property, which includes:

- Qualified Opportunity Zone Business Property (QOZBP)

- Qualifying partnership interests or stock in a Qualified Opportunity Zone Business (QOZB)

Qualified Opportunity Zone Business Property is tangible property used in a trade or business if all of the following three requirements are met:

- The property is acquired by purchase after December 31, 2017;

- Either:

- The original use of the property in the QOZ commences with the QOF (or QOZB); or

- The QOF (or QOZB) substantially improves the property; and

- During substantially all of the QOF’s (or QOZB’s) holding period for the property, substantially all of the use of the property is in the QOZ.

Leased property is also available for designation as Qualified Opportunity Zone Business Property with some separate requirements.

A Qualified Opportunity Zone Business is an eligible entity engaged in an active trade or business that meets the following requirements:

- At least 70% of the tangible property owned or leased by the QOZB is QOZBP

- At least 50% of the QOZB’s gross income is derived from the active conduct of a trade or business in the QOZ, or in multiple OZs

- At least 40% of the QOZB’s intangible property is used in the active conduct of a trade or business in a QOZ

- Less than 5% of the average of the aggregate unadjusted bases of property is attributable to nonqualified financial property (NQFP), which does not include reasonable amounts of working capital held in cash, cash equivalents or debt instruments with a term of 18 months or less

A QOZB can be a new start-up or a pre-existing entity but cannot involve the operations of certain “sin” businesses.

Moving Forward with Opportunity Zones

Investing in Opportunity Zones may look different depending on the specific situation. The best way to navigate the Opportunity Zones program and the numerous regulations and requirements that come with it is to partner with a tax advisor who can offer insights into your particular situation.

This blog was originally published by Warren Averett on August 17, 2018, and was most recently updated with new information and insights on December 29, 2021.