Seven Ways to Protect Yourself Against Cybercrime While Doing Your Online Holiday Shopping

With the holidays right around the corner, decorations are going up, lights are being strung, and gifts are being purchased and wrapped. But, unfortunately, it’s not only “the most wonderful time of the year” for you and yours; it’s the most lucrative time of the year for cybercriminals too.

As our world becomes more reliant on technology, it’s unfortunately no surprise that cybercrime is increasing as well.

During the holiday season, cybercrime becomes particularly prevalent because, with the increase in transactions, there are more opportunities for cybercriminals to exploit more individuals.

How Do I Protect Myself Against Cybercrime?

As you consider skipping the traffic, crowds and lines to opt for an online shopping experience, keep in mind that cyber thieves are actively on the prowl, looking to steal identities and commit fraud.

So if you’re going to shop online—whether it’s for your personal gift giving or for corporate holiday purchases—make sure you’re always taking proactive steps to protect your information.

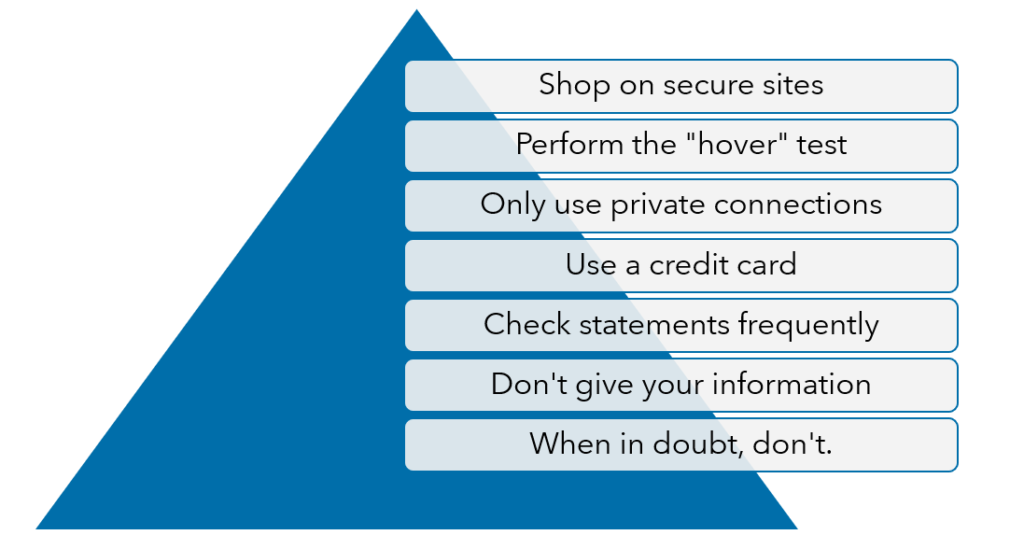

Here are seven simple ways you can do that this holiday season:

1. Always verify that you’re on a secure site.

A quick way to verify whether a site is secure or not is to look for a small padlock icon in the web address bar. It’s also very important to confirm the address begins with “https://” instead of “http://,” which indicates an unsecured connection.

2. Perform the “hover” test.

Before clicking any link or responding to any email, always hover your mouse over the sender address or the included link. Hovering over a link will cause the embedded link address to pop up.

If the link address or information that pops up looks suspicious, this will allow you to stop before it’s too late. In addition, verifying that the sender address matches the website address and that the sender information (such as spelling) is correct will go a long way to protect you.

3. Elect to shop online only when on a private device or private Wi-Fi network.

Shopping on a public device puts you at risk because it’s almost impossible to know if that device has already been compromised by spyware or malware. There’s also a chance you might forget to log out of your account, leaving your information exposed on that device.

Additionally, making sensitive transactions, viewing sensitive information or accessing your financial information on a public Wi-Fi network puts you at risk.

On a public network, thieves can more easily intercept any data, including credit card numbers and passwords. For example, it would be better to log on to your financial institution’s website from your phone using cellular data instead of Wi-Fi.

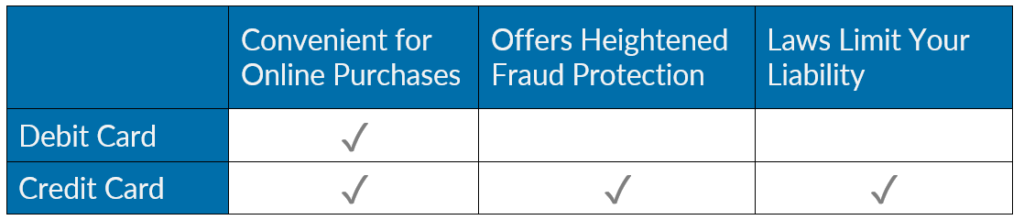

4. Use a credit card, not a debit card.

Debit cards withdraw money directly from bank accounts and don’t offer the same level of protection from fraud that credit cards do. There are laws in place that limit your liability concerning credit card fraud that aren’t in place when it comes to performing debit transactions.

Utilizing a payment gateway, such as Apple Pay or PayPal, also adds another layer of protection, instead of inputting the information from your personal or corporate bank or credit card.

5. Check your bank statements frequently.

Whether you use a credit card or a debit card, make it a habit to check your bank account information frequently for accuracy. This can be said for both personal and corporate accounts.

The quicker you notice strange activity, the faster you can take steps to protect yourself. Keep a record of your transactions, including confirmation information. If you notice an issue or discrepancy, take steps immediately to protect your identity.

The U.S. Department of Homeland Security offers tips for preventing and responding to identity theft that are worth reviewing as well.

6. Don’t respond to requests for information.

A reputable retailer is not going to send you a request via email to update private information. They realize this puts your information at risk.

If you receive a notification about your purchase or are asked to provide updates to your information, it’s better to pick up the phone and contact the company directly or log on to the authentic website by typing the known, secure web address of the company yourself.

This will allow you to validate the request and protect your information if the request is not legitimate.

7. When in doubt, just don’t.

Finally, if you have any concerns or doubts about a website, transaction or email, don’t risk it.

The holidays are supposed to be a time of enjoying the things that are most important to us, like our family and friends. The last thing any of us have time for this year is to worry about our financial information being exploited or having to put out proverbial fires related to our identity.

Don’t let the lure of convenience cause you to make poor decisions.

Learn More about Cyber Safety for Your Business

These seven tips will help you to keep an eye out for cybercrime this holiday season, and hopefully, you can avoid experiencing it for yourself.

Remember, the only way to fully avoid online shopping cybercrime is to simply pull on your favorite jacket, throw a warm, colorful scarf around your neck and get behind the wheel.

Trust us when we say the inconvenience of bumper-to-bumper traffic and a little holiday insanity is worth your peace of mind this season.

Happy Holidays to you and yours from Warren Averett’s Risk Advisory & Assurance Services team!

This article was originally published on November 25, 2019 and most recently updated on November 11, 2022.