Nonprofit Financial Management: Who is Responsible?

Who is responsible for nonprofit financial management and reporting?

Is it the Audit Committee? The Board of Directors? The Executive Director or the Chief Financial Officer? And what about other key members of management?

The answer: all of the above.

There isn’t one singular person responsible for financial management and reporting in a nonprofit organization. But different individuals and groups have important and specific roles when it comes to nonprofit financial management.

The Audit Committee’s Nonprofit Financial Management Responsibilities

Nonprofit financial management and reporting should be considered with a top-down approach, beginning with the Audit Committee. Every Audit Committee should have a charter that clearly identifies their roles and responsibilities.

These responsibilities should include:

- Oversight of the overall financial reporting process;

- Selection and review of external auditors;

- Review and approval of the annual audit and IRS Form 990; and

- Monitoring actual performance against the budget.

For smaller organizations, the Finance Committee often fills the role of the Audit Committee when it comes to nonprofit financial management. There are several resources that Audit Committees or Finance Committees can refer to for a better understanding of their roles and responsibilities, including the AICPA Audit Committee Toolkit for nonprofit organizations.

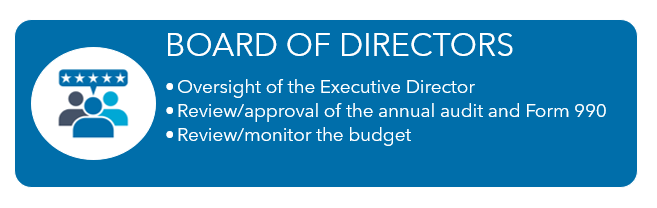

The Board of Directors’ Nonprofit Financial Management Responsibilities

The Board of Directors is also responsible for certain aspects of nonprofit financial management and reporting.

While the Audit Committee or Finance Committee will review and approve the annual audit and IRS Form 990, the full Board will also be asked to approve these documents based on the recommendation of the Audit Committee.

Board members shouldn’t just rubber-stamp these documents. It’s important that they understand what they are approving because they ultimately have fiduciary responsibility for the nonprofit organization.

As with the Audit and Finance Committees, the Board is also responsible for reviewing and monitoring the nonprofit’s budget. The Board should have a basic understanding of nonprofit financial statements and budgeting, so that they can ask appropriate questions about the overall nonprofit financial management.

Speaking from experience as a Board treasurer, when the Board doesn’t ask any questions after the treasurer provides monthly reports, it raises a concern that Board members don’t understand the information in enough detail to ask questions.

This isn’t surprising; many nonprofit Board members have spent their careers working in for-profit enterprises. They just don’t have the experience with reading and understanding nonprofit financial statements.

For this reason, organizations should consider including nonprofit financial management and reporting training as part of new Board member orientation.

Questions that Board members should be trained to ask as part of their role in nonprofit financial management include:

- Do we have enough cash inflows to cover operations, or are we living off reserves?

- Do we have enough cash on hand to cover at least three months of operating expenses?

- What portion of our funds are being spent on program activities?

- Are we relying on one or two major sources of funding?

- How much does it really cost for us to raise money?

- How much are we spending on administrative expenses?

The Board of Directors is also responsible for oversight of the Executive Director.

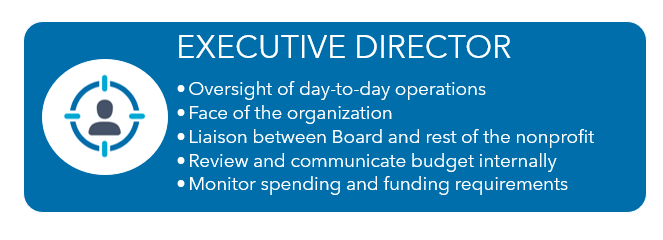

The Executive Director’s Nonprofit Financial Management Responsibilities

The Executive Director oversees the day-to-day operations, serves as the “face” of the nonprofit and acts as the liaison between the Board and the rest of the organization.

The Executive Director should be able to understand and articulate the nonprofit’s financial information so that they can effectively communicate with the Board, as well as with donors and potential funders. The Executive Director should also routinely review budget-to-actual performance and should communicate with department heads regarding budget variances.

Therefore, the Executive Director needs to be able to both interpret the nonprofit financial management and reporting that is coming from various departments as well as communicate the information to the Board and various stakeholders.

The Executive Director needs to monitor spending and make sure that the organization is on track with funding requirements. Inattention to budgeting, spending and funding requirements can result in both reputational and financial damage.

Although the Executive Director is ultimately responsible for the day-to-day operations, it is imperative that they have a good management team below them in order to effectively do their job.

The Management Team’s Nonprofit Financial Management Responsibilities

The management team is the last line of defense when it comes to accurate nonprofit financial management and reporting.

Key members of management should be involved in the budgeting process. This includes asking for their input and helping them understand how their departmental budgets fits into the overall financial reporting of the nonprofit.

When they understand how their departments’ results impact the overall organization, managers take more pride in the budget and will work harder to monitor budget performance. When they don’t understand the importance of the budget, they don’t worry as much about the results.

There should also be an open line of communication between management and the Executive Director, so that management can be empowered to communicate their departments’ financial information to the Executive Director. This allows the entire team to be proactive in sound nonprofit financial management, as opposed to reactively responding to financial issues.

Learn More about Nonprofit Financial Management and Reporting

The responsibility for nonprofit financial management and reporting lies with the Audit Committee, the Board, the Executive Director and key management of an organization. The key is providing these individuals with appropriate training to understand their roles and responsibilities.

If you would like further information about nonprofit financial management training for your organization, please contact your Warren Averett advisor, or ask a member of our team to reach out to you.

This article was originally published on May 4, 2021 and most recently updated on November 16, 2023.