What is Form 5500? [Plus Why It’s Important and Who Needs to File One]

In order to fully answer the question: “What is Form 5500?,” you’ll want to not only understand what the Form is, but how it’s completed, what information it contains and how it’s filed.

What is Form 5500?

Form 5500 is an important tool in ERISA’s disclosure and reporting framework. It’s the collaborative product of three government agencies in the United States:

- the Pension Benefit Guaranty Corporation (PBGC),

- the Internal Revenue Service (IRS), and

- the Department of Labor (DOL).

To be more specific, Form 5500 provides federal agencies with an annual report that includes information about the benefit plans that are offered by employers—and the finances and operations of these plans.

What is ERISA?

The Employee Retirement Income Security Act (ERISA) is a federal law that applies to most private employers. ERISA established standards for health, retirement and other welfare benefit plans in order to protect both employees and employers.

Simply put, ERISA is legislation that applies to any private entity that offers benefit plans that fall under their scope of authority. This legislation requires that employers comply with specific standards that include disclosures, financial protection, reporting and accountability, procedural safeguards, as well as the conduct of the employee benefit plan (EBP).

What is an Employee Benefit Plan?

The term “employee benefit plan” refers to a pension, 401(k) or profit-sharing plan.

Is Form 5500 Only for Employee Benefit Plans?

The following plans are also subject to Form 5500 filings if they have 100 employees or more:

- Medical, vision, dental or other health plan;

- Any life insurance plan;

- Flexible spending account;

- Cafeteria plan;

- Vacation;

- Holiday;

- Disability; or

- Any other employee benefit plan or fringe benefit plan.

What Information Goes in the Form 5500?

Form 5500 consists of the main form, in addition to various schedules and attachments that supplement the comprehensiveness of the main form.

In completing Form 5500, a private entity will provide specific information about their employee benefit plan that may include, as applicable:

- Accountant report, if plan meets threshold for an audit requirement;

- Actuary contact information (defined pension plan);

- Information concerning all insurance contracts used (in the event the plan has insurance contracts); and

- Schedules concerning liabilities and assets.

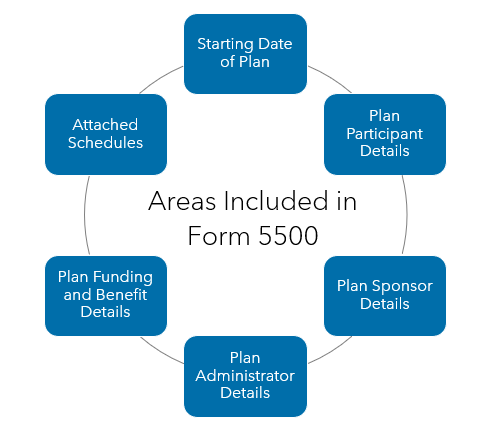

The Form 5500 encompasses areas that include:

- The starting date of your plan;

- Details about the number of participants in the plan;

- Plan sponsor details;

- Details of the plan administrator;

- Information about the funding of the plan and provided benefits; and

- Attached schedules.

Note that the required schedules depend on the characteristics of your employee benefit plan.

What Type of Form 5500 Do I Need?

The type of Form 5500 that is needed depends on the plan. There are three main types that are used:

- Form 5500 is generally used for an EBP that contains at least 100 participants

- Form 5500-SF is generally used for organizations with less than 100 participants in their EBP

- Form 5500-EZ is used for EBPs that are maintained from outside the U.S. or for owner-only plans

What is the Difference Between Form 5500 and Form 5500-SF?

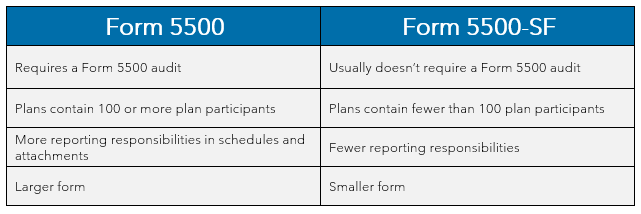

Form 5500 and Form 5500-SF have one main difference that employers need to know.

Whether you file Form 5500 or Form 5500-SF depends on a few key qualifiers. One of the primary differences is that a Form 5500 audit is generally required for plans that require the use of Form 5500. A Form 5500 audit normally does not apply to plans that file Form 5500-SF.

Form 5500-SF is used for the annual filing of plans that contain between one and 100 plan participants. This type of Form 5500 is much smaller and places significantly fewer reporting responsibilities on employers for filing their reports.

Note that “plan participants” is a term that includes all eligible employees who are not yet participating, active participants and deceased, separated or retired individuals who currently receive benefits from an employee benefit plan.

In contrast, Form 5500 generally applies to any employee benefit plan that contains 100 or more participants. This larger filing requires schedules and attachments in addition to the Form 5500 to be filed each year.

Who Files Form 5500?

The administrator of an employee benefit plan is ultimately responsible for filing the relevant Form 5500.

Often, a company’s finance, HR or operations department, or any combination of these departments, will prepare the Form 5500. Alternatively, a third-party administrator may be used to file Form 5500.

What Are the Form 5500 instructions for Filing?

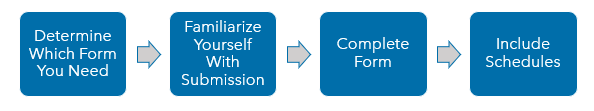

Filing your Form 5500 takes a few steps:

1. Determine which Form you need

The first step in the filing process for Form 5500 is to determine which type you are required to submit, whether it’s a Form 5500, Form 5500-SF or Form 5500-EZ.

2. Familiarize yourself with the tools you’ll need to file your Form 5500

Subsequently, you should be aware that the Department of Labor requires Form 5500 to be filed electronically by using the ERISA Filing Acceptance System (EFAST2) program. This system is designed to help simplify the processing, submission and receipt of your Form 5500.

3. Complete your Form 5500

Next, you must fill out Form 5500, which is three pages in length and requires details concerning your EBP.

4. Include the relevant schedules

Prior to reviewing your information and submitting your Form 5500 by the required deadline, it’s vital to ensure you include the relevant schedules to avoid penalties or delays in processing.

What Schedules Should I Include With my Form 5500?

When it comes to the schedules needed for your Form 5500, it’s important to carefully review the guidelines. Schedules to accompany Form 5500 may include:

- Schedule A – covers insurance information

- Schedule C – deals with service provider information

- Schedule D – encompasses information concerning the direct filing entity

- Schedule G – refers to financial transactions of the plan

- Schedule H – deals with financial information for a large EBP

- Schedule I – deals with financial information for a small EBP

- Schedule MB – pertains to multi-employer defined benefit plans as well as certain money purchase plan actuarial information

- Schedule R – covers information for retirement plans

- Schedule SB – relevant for single-employer defined benefit plans and details actuarial information

These schedules are critical for fulfilling your annual reporting duties for any plan subject to ERISA and Form 5500 audit requirements.

What Can Companies Do to Ensure Compliance When Filing a Form 5500?

It’s imperative to submit all required documents with your Form 5500 filing. Be sure to determine your status before starting the filing process. If you fail to file or fail to meet the filing requirements for Form 5500, the IRS and DOL may impose penalties or fines.

Where Can I Find Help Preparing My Form 5500?

The experts at Warren Averett can help you in preparing the required documents. We know how challenging it can be to effectively prepare a Form 5500.

Something so important deserves the help of qualified professionals to make the process efficient and smooth. Contact our team today for additional help in understanding how to answer the question: “What is Form 5500?”

Our specialized team of benefit consultants can help you complete the timely preparation and filing of your Form 5500, as well as any plan design or administration that fits your company’s needs.

This article was originally published on February 10, 2021 and most recently updated on January 5, 2023.