How an R&D Tax Advisor Can Help You Claim the Credit

Through the research and development (R&D) tax credit, qualified companies can gain immediate cash benefits that can be used to offset both income taxes and payroll taxes in certain instances. This credit can reduce your tax liability dollar-for-dollar.

But the R&D tax credit isn’t just for large companies with dedicated R&D departments. Small and medium-sized companies are also eligible for significant savings through the R&D tax credit.

If your company has made improvements to products, processes or software, or even if you’ve tried to make improvements and have been unsuccessful, you could be eligible for tax benefits.

Download our comprehensive guide to R&D Tax Credits here.

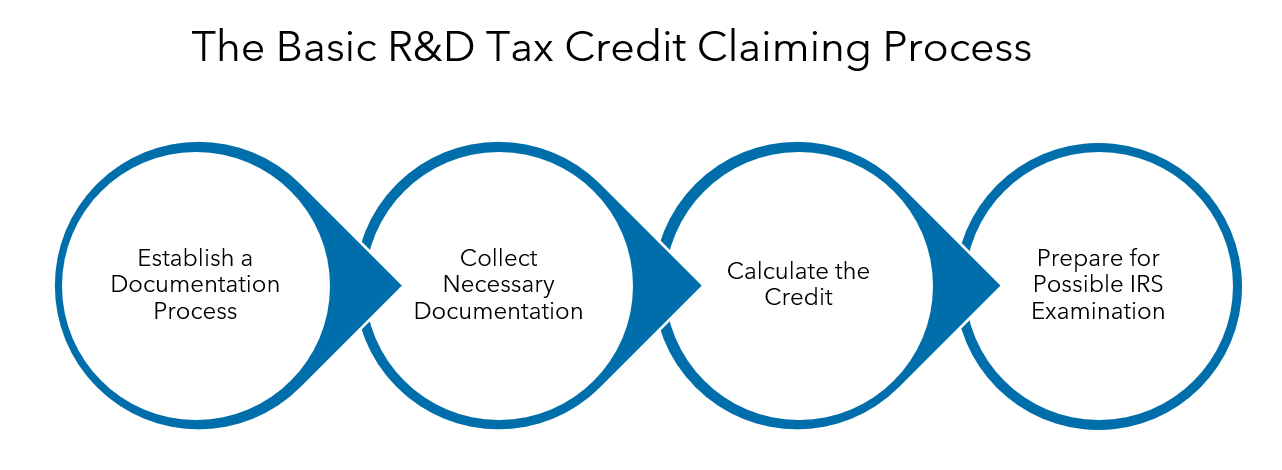

So, How Do You Claim the R&D Tax Credit, and How Would an R&D Tax Advisor Help?

While the steps to claim the credit may seem straightforward, tax laws around R&D are highly complex—and always changing. Claiming the R&D credit requires a deep understanding of the tax code and the research and development tax credit process, so most companies that are successful in claiming the credit have a trusted R&D tax advisor to guide them through the process.

Here, we’ve outlined the four basic steps for claiming the R&D tax credit, as well as what role your R&D tax advisor should be playing throughout the process so you know exactly what to expect.

Step 1: Establish a Documentation Process Early

Documentation is the most important step for claiming the R&D tax credit and should begin as soon as possible. Preparation is key. Documenting the necessary information is critical to receiving the highest benefit early on in the project planning stages.

Establishing your company’s documentation process before you begin and avoiding the common documentation errors can be helpful when claiming the R&D tax credit. By documenting early on, you can eliminate the need to go back retroactively and find the necessary information.

Depending on your specific company and your activities, your R&D tax advisor will be able to talk your company through how to best prepare to record the right information and how to set a process before you begin.

Step 2: Collect the Necessary Documentation

It’s important to evaluate any potential activities your business is currently performing or planning to perform that might be eligible for the R&D credit. Once you’ve identified the potentially eligible activities, you can begin recording qualifying expenses and start documenting the necessary information.

To date, the IRS has not established a clear definition of what documentation is required to claim the R&D tax credit. However, the main goal with documentation is to prove that your company’s activities qualify for the credit. Any supporting documentation will be helpful in stating a claim.

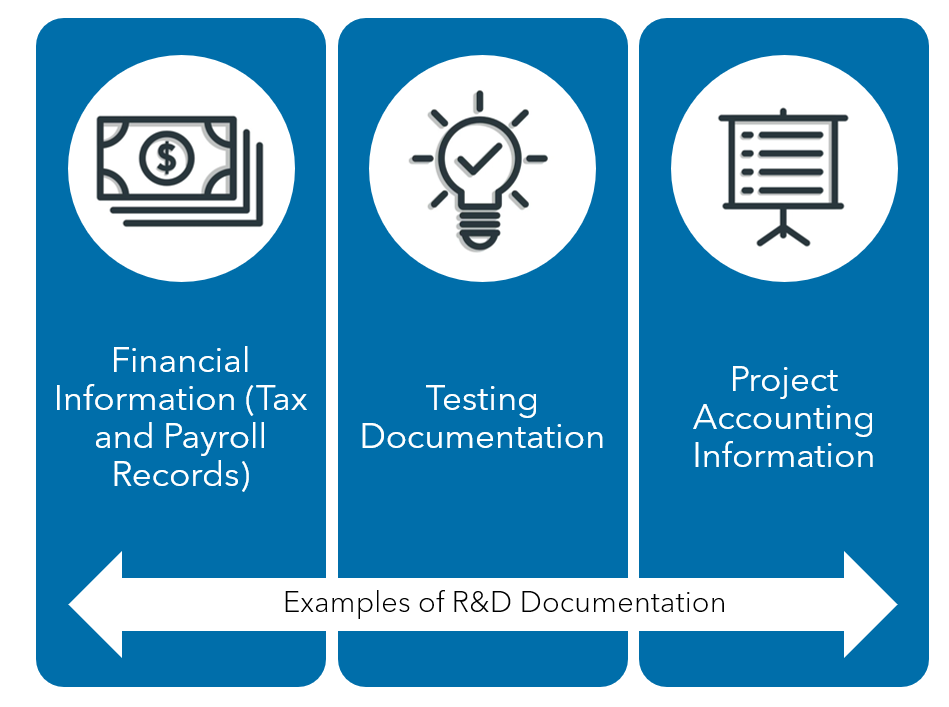

Your R&D tax advisor will likely recommend you retain the following documents at a minimum:

- Financial information such as tax and payroll records

- Testing documentation, including project records, lab notes, design drawings, prototypes, patent applications

- Time tracking reports, expense reports and other project accounting information

Because each developmental project and company is unique, each opportunity to receive the R&D tax credit will be unique, and your R&D tax advisor will be able to offer insight into your specific situation.

Step 3: Have Your R&D Tax Advisor Calculate the Credit

After you’ve established your documentation process with your R&D tax advisor and begun collecting the necessary information to support your claim, you can begin to work with your R&D tax advisor to complete the IRS Form 6765, Credit for Increasing Research Activities.

Your R&D tax advisor can help to ensure that your company is adhering to the specific instructions for Form 6765 and will submit this form with your business’s annual income tax return.

If you have unused credits, the IRS allows you to carry those forward for up to 20 years. Companies can also take advantage of refunds for the past three years by filing an amended return. Any company thinking about amending its tax return for the R&D credit should be aware of the Office of CCA’s revised administrative policy regarding research credit claims.

Step 4: Prepare for a Possible IRS Examination

IRS examinations are always a possibility, and filing for the R&D credit is no exception.

If the IRS examines an open position and finds that the credit you are filing for has not met the R&D requirements, the credit will be disallowed either partially or completely.

If the IRS finds that the credit was either claimed through negligence or did not meet the rule or requirements, there may be penalties involved. Additionally, taxes in the year that a credit was claimed, as well as additional tax years, can be impacted if the IRS disallows the claimed credit.

The risks associated with the R&D tax credit should not discourage you from exploring your eligibility. If you have the right R&D tax advisor, you’ll be confident that you are taking the proper steps and documenting information that will help your company state its claim.

Your R&D tax advisor should also stay committed throughout the entire process—and in the event of an IRS examination or subsequent appeals.

Find the Right R&D Tax Advisor to Help You Claim the Credit

The R&D tax credit can be complex, and each company’s process can be different from another’s. The right R&D tax advisor can make all the difference when it comes to claiming the research and development tax credit.

Warren Averett’s R&D tax advisors can help you to determine if you are eligible and assist with every step of the R&D process, including project initiation and data collection, identifying qualified projects and expenses, documentation, R&D tax credit calculation and completing the necessary forms.

Complete this form to have one of our R&D tax advisors reach out to you to get the conversation started.

This article was originally published on 2.22.19 and most recently updated on 2.22.22.