How to Prepare Your Business for a Natural Disaster

Natural disasters strike with little to no warning, so all businesses should be prepared.

Through helping our clients navigate natural disaster recovery for their businesses, and through traversing our firm’s own challenges associated with recovering from Hurricane Michael damages in 2018, we have assembled what we believe are the top ways to prepare your business for a natural disaster.

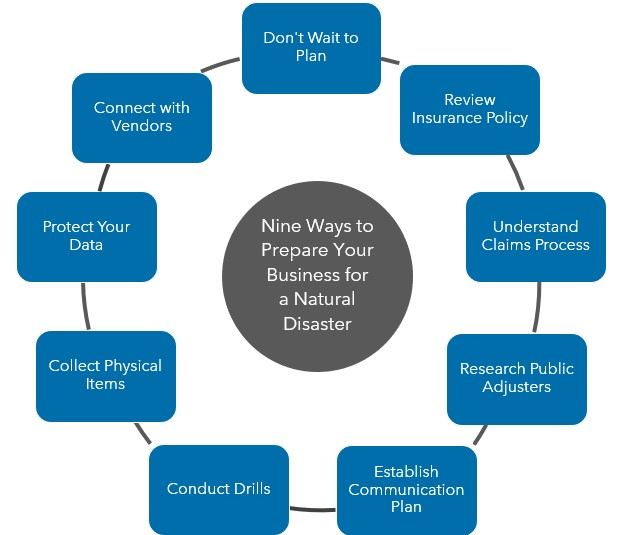

Nine Ways to Prepare Your Business for a Natural Disaster

1. Don’t wait to make a plan.

Natural disasters, including hurricanes, often come about with little to no warning. It’s important to gather resources, formulate policies and think through challenges now to position your business in the best way possible.

Time may not allow for effective preparedness once you are anticipating a disaster, so it’s important to have a solid plan ahead of time.

2. Review your insurance policy.

Possibly the most important step that you can take to prepare your business for a natural disaster is to thoroughly review your insurance policies to ensure that you have the coverage that you need—and perhaps more importantly, the coverage that you believe you have.

Because many insurance providers won’t provide new insurance coverage or make changes to existing coverage after a hurricane has formed, it’s essential to assess your needs and coverages ahead of time.

Review your coverage limits, including provisions for business interruptions, and determine if the coverage meets your possible needs (i.e., how much time post-disaster does the business interruption policy cover?).

Helpful things to consider are coverages for stand-alone and exterior structures and if you have or need wind and/or flood coverage.

3. Gain an understanding of your insurance company’s claims process.

After a significant disaster, there can be a great deal of confusion in the affected area, so having a solid understanding of the claims process beforehand is extremely advantageous.

The claim experience varies from company to company and situation to situation, so it can be helpful to prepare your business for a natural disaster by having your insurance company provide information about basic expectations.

After a natural disaster, many insurance companies will open temporary locations so that you can file a claim in person. Many more will open your claim via phone or online.

The general process is that, once the claim is opened, you will be given a claim number, and an insurance adjuster will come to your property to inspect the damage and estimate the loss. Take notes of your adjuster’s visit and be certain that the adjuster is checking all locations of the property where there is potential for damage.

You will eventually receive an adjuster’s report that shows the estimate of the loss, less certain reductions for deductibles and depreciation, depending on the individual policy.

If you feel the assessment is inaccurate or unfair, you can typically request a second adjuster’s evaluation from your insurance company, or you can ask your contractor to meet with the insurance representative to agree on scope of damage.

4. Research public adjusters.

In some instances, you may seek the assistance of a public adjuster. If needed, a public adjuster can serve as your advocate when negotiating an insurance claim.

These individuals charge a fee, typically under a scheduled percentage of the insurance proceeds recovered.

To be proactive to prepare your business for a natural disaster, we recommend doing research on various public adjusters prior to any disaster and keeping their contact information readily available should you decide you need their services.

5. Establish a disaster communication plan.

Establish a communication plan with your employees to connect about their safety and needs in the event of a disaster.

When formulating your plan, consider that many resources normally used for communication, like internet or mobile phone service, may be limited in a disaster area.

Depending on your team’s size, locations and available resources, you may want to consider implementing a phone tree or formulate another method of communication.

After you’ve considered how to ensure your team’s safety after a disaster event, consider what business operations might look like for your team to operate and communicate with each other in a de-centralized manner.

You may want to consider using mobile hotspots or commuting to a designated location, depending on your team and how quickly the various communication methods are restored.

6. Simulate a disaster and practice your policies.

Consider the “what ifs” that could impact your business in a natural disaster and create a plan that outlines the actions to take and resources needed in the event of such a disaster.

Document how your business would prepare and respond to the disaster and practice the procedures you put in place. Creating disaster drills can familiarize your team with the right protocol so that if a disaster does occur, your employees are already equipped with the knowledge that they need.

7. Collect the physical items that you may need beforehand.

Consider storing essential items that would be beneficial to have on hand at a convenient location in the wake of a natural disaster. You may want to establish a kit at your office that holds batteries, phone chargers and other useful items.

Common items like tarps and generators may be expensive or in short supply, so consider obtaining essential items before a threat exists to best prepare your business for a natural disaster.

It’s important to periodically evaluate what items you might need and if the ones that you have on hand are in good working condition.

8. Make sure your information and data are protected.

It’s important to create redundancies and protection policies for your data and information. Start now to establish a cybersecurity and technology plan that meets your business’s needs.

Back up critical electronic information to an offsite location and consult your IT provider to ensure that your data has been successfully saved offsite. Print critical business documents and data beforehand and protectively seal them so that you can continue any important business operations through potential power outages.

Consider keeping physical copies of important insurance documents in an easily accessible location in the event that electronic versions are unavailable after a disaster.

Consider scheduling a clean shutdown of your business’s hardware, which would prevent a hard shutdown from a power outage. After completing the scheduled shutdown, unplug devices, printers and other office equipment and wrap them in durable plastic to protect from possible water damage.

9. Connect with critical vendors.

Identify your business’s important suppliers to gain an understanding of their own disaster plans and how your company’s interactions with them may be impacted if a natural disaster occurs.

What are their policies and processes? How would your business be able to operate if your vendors were unable to fulfill essential duties in a disaster? Think through a plan for your business’s operations to continue if resources are limited.

It’s also helpful to determine how your interactions may impact your business’s own customers and the services or goods that you provide to them. How will you communicate essential information to them?

Learn More about How to Prepare Your Business for a Nature Disaster

At the end of the day, you can’t be too prepared when it comes to protecting your business, your team and yourself from natural disasters.

For more information about how your business can prepare for or recover from a natural disaster, contact a Warren Averett advisor.

This article was originally posted on September 25, 2019 and was most recently updated on May 10, 2022.