“You Have Been Selected for Audit” [Most Frequently Asked Questions about Sales Tax Audits Answered]

The letter from the state reads: “You have been selected for audit.”

Little else strikes fear in a taxpayer’s mind quite like these six words. After the initial shock wears off, what’s next? Where do you start?

We’ve assembled a few of the most frequently asked questions that we hear from companies once they’ve been selected for a state tax audit (and the answers) to guide you through the typical state sales and use tax audit process.

What is a sales and use tax audit, and what is the state’s goal in conducting one?

Very broadly, the state auditor’s goal is two-fold:

To determine if your company collected and remitted the proper amount of sales tax from your customers (trust fund taxes); and

To verify if your company has paid and/or self-assessed the proper amount of sales/use tax on your purchases made during the audit period. Purchases will include both capital assets and operating expenses.

Does a state have the right to come to our location and to view our records?

Yes. Registering to do business in a state makes you subject to a state tax audit, and, therefore, the state is allowed to examine your books for compliance (with proper notice).

Who conducts a state sales and use tax audit?

Sales and use tax audits are conducted by state Departments of Revenue, as well as local municipalities in certain states.

What is the lookback period for a sales and use tax audit?

If you have filed in a state, the state will generally look back three to four years. If you have never filed in a state, there is technically no statute of limitations, and the state may want to go back to when the company first started doing business in the state.

What should I do if I received a call from the auditor instead of a letter?

You should always receive a letter from the taxing authority. If you receive a call, ask the auditor to send a formal letter outlining the audit period and legal entity to be audited.

How are tax returns selected for audit?

Tax returns are selected for audit through either a random process or an “audit lead” identified by an auditor during the audit of another taxpayer.

When and how should I respond to an audit letter? What information will they request?

You should respond well within the time frame listed in the letter. It’s best to respond in writing (email is fine) to document your response.

Ask to set up a call to discuss the scope of the audit and records needed to conduct the review. The auditor will normally issue a request with an all-inclusive list of information.

Review each request, and determine what is actually needed for them to perform their review. Does the auditor really need your bank statements to conduct the audit?

What should I expect during the auditor’s visit?

The length of the visit may vary from a few hours to a few days. The audit may begin with an entrance conference to discuss the scope of the audit and to determine timing needed to conduct the review.

The auditor may ask for a tour of the facility to gain a better understanding of the company operations. You should always have a member of the tax team conduct this tour.

How long does a state sales and use tax audit take to complete?

The time can vary from a few weeks to several months, depending on the specific situation.

What do state tax auditors look for in an audit?

The auditor looks for evidence of tax underpayment. The auditor typically takes a top-down approach: starting with the sales tax returns your company has filed and agreeing them to your books and records.

What are the sales and use tax audit procedures?

The auditor will most likely propose using a sample to test the sales and operating expenses. Assets are reviewed in detail.

There are several accepted types of samples. Most states now offer and encourage the auditors to use a transaction sample. Other options include a block sample and vendor sample. Before agreeing to a sample, make sure you understand the process and which one will best fit with your records for sales and operating expenses.

If an underpayment is found, the auditor will prepare various supporting schedules or workpapers documenting his/her findings. You will be given the opportunity to review the schedules and propose any challenges. It’s always advisable to reach an agreement with the auditor on the audit results before a formal billing is issued.

Once the schedules are finalized, the auditor will issue a formal request for payment. This billing will summarize the exceptions found in the sales and use tax audit, list any penalty and interest due and provide a due date (usually 30 days) to respond and make payment.

Once the final assessment is delivered, you should immediately review your options and determine the best course for you given your fact-pattern. If you agree with the results, you can make payment and close the audit.

If you do NOT agree with the audit results, you can request a conference to try to resolve the issue or file an appeal at the administrative level. Timing is always critical in the audit wrap-up steps; failure to meet a deadline could prevent the company’s ability to make an appeal.

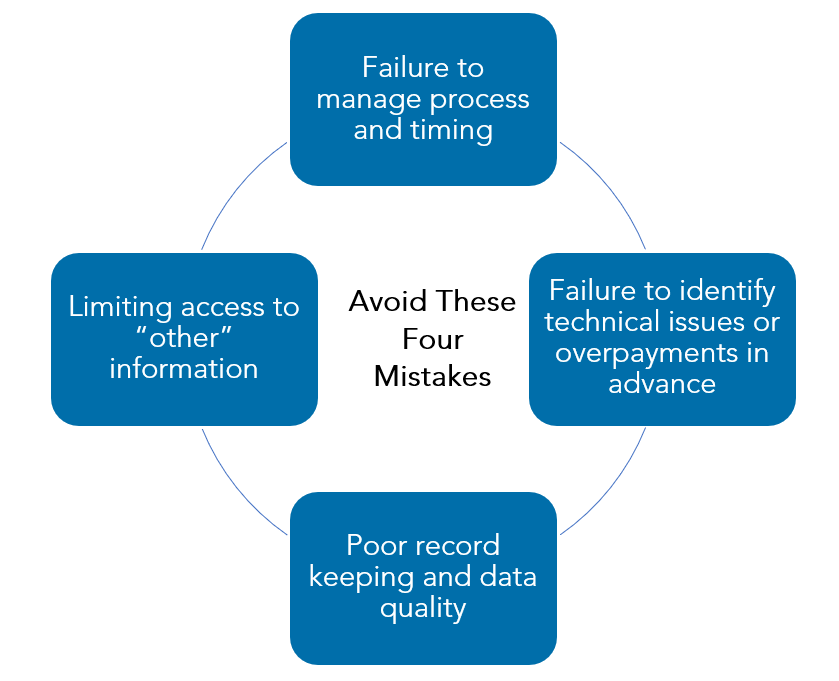

What are the most common mistakes or issues companies face in a state tax audit?

We see that these four mistakes are the most common:

- Failure to manage process and timing

Responsiveness is key. If the state audit is taking longer than expected, the auditor may ask for a statute waiver to lengthen the time with which the state has to complete the audit beyond a normal statute period.

If the company has been diligent about responding timely to requests with good information, the company may be able to persuade auditor to complete the audit without a waiver. However, the decision to sign or not sign a waiver is highly facts dependent.

In general terms, it is usually in the best interest of the taxpayer to sign the waiver to keep the audit period intact. Work with the auditor to keep the audit moving and minimize the number of waivers needed.

- Failure to identify technical issues or overpayments in advance

Before you turn your records over to an auditor, it’s a good idea to conduct a self-review. The best way to enter the sales and use tax audit is to become very familiar with the information that has been requested.

If time permits, you should perform a review of all documents to know exactly what information you are giving the auditor and where potential issues or overpayments may lie.

- Poor record keeping and data quality

Keep up to date with collection of exemption certificates. Be involved in setting tax data retention policies at your company, especially if implementing a new ERP system.

It seems inevitable that gathering historical data for an audit always takes more time and causes more frustration than it theoretically should; expect and plan for that outcome and be pleasantly surprised if you easily get what you need.

Giving an auditor information that is not accurate or incomplete will erode the integrity of any future data provided and open you up to questions, which may be unwarranted.

- Limiting access to “other” information

Technically, the auditor should see only the records for the business conducted in the state for which she or he is auditing—and only for the defined audit period.

Be cognizant of the fact that auditors are trained data gatherers, so they will be taking notes during every aspect of their visit and from all publicly available information (e.g., social media).

How can I find help for my company with a sales and use tax audit?

It’s often helpful for companies to find a partner to assist with a sales and use tax audit, especially when it comes to the following activities:

- Hosting, managing and overseeing the auditor’s visit

- Working with your team to manage the audit process, data flow and deadlines

- Responding to all auditor questions to provide insulation between you and the auditor.

The information in this article is presented solely for educational purposes and should not be construed as actual advice in a specific audit. Any reference to taxability issues has been purposely omitted.

Reba Pennington, CMI, is a consultant at Warren Averett and is a former state tax auditor. Reba has saved her clients millions of dollars by properly managing and defending their sales tax positions, providing measurable benefit and adding immediate value. You can contact her directly for more information at Reba.Pennington@warrenaverett.com.

Colleen Aldridge, CPA, is a Manager in Warren Averett’s Consulting Division, where she uses her 22 years of tax experience to help companies optimize their state tax filing positions. You can contact her directly for more information at Colleen.Aldridge@warrenaverett.com.